A Biased View of Affordable Bankruptcy Lawyer Tulsa

A Biased View of Affordable Bankruptcy Lawyer Tulsa

Blog Article

The Main Principles Of Tulsa Bankruptcy Legal Services

Table of ContentsFacts About Tulsa Bankruptcy Attorney RevealedTop-rated Bankruptcy Attorney Tulsa Ok for BeginnersLittle Known Facts About Chapter 7 Bankruptcy Attorney Tulsa.The Greatest Guide To Bankruptcy Attorney TulsaGetting My Tulsa Bankruptcy Filing Assistance To WorkThe Tulsa Bankruptcy Consultation PDFs

Individuals have to use Chapter 11 when their debts go beyond Phase 13 debt limits. bankruptcy attorney Tulsa. Phase 12 insolvency is developed for farmers and fishermen. Phase 12 repayment strategies can be a lot more flexible in Phase 13.The means examination looks at your typical month-to-month revenue for the six months preceding your filing date and contrasts it versus the mean income for a comparable house in your state. If your income is below the state median, you instantly pass and do not need to finish the entire type.

The financial debt limits are detailed in the graph above, and existing amounts can be confirmed on the U.S. Judiciaries Phase 13 Bankruptcy Basics web page. Discover a lot more about The Means Test in Chapter 7 Bankruptcy and Financial Debt Limits for Chapter 13 Personal bankruptcy. If you are wed, you can file for insolvency collectively with your partner or individually.

Filing personal bankruptcy can aid an individual by discarding debt or making a strategy to pay back financial obligations. A bankruptcy situation generally starts when the borrower submits a request with the insolvency court. A request might be filed by an individual, by spouses together, or by a company or other entity. All insolvency situations are handled in federal courts under regulations detailed in the U.S

Excitement About Chapter 7 Vs Chapter 13 Bankruptcy

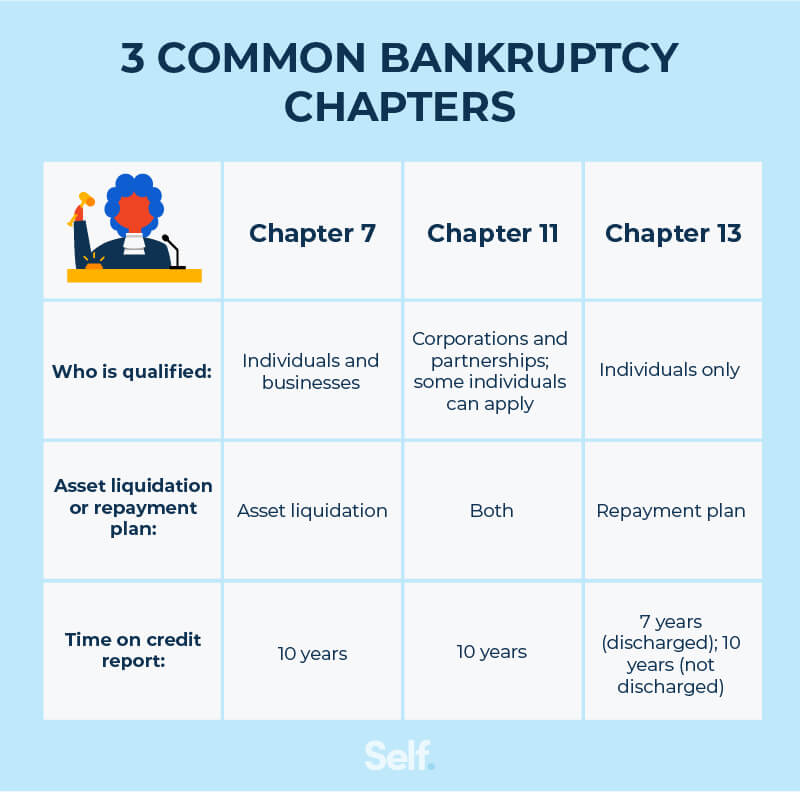

There are different sorts of insolvencies, which are usually described by their phase in the U.S. Insolvency Code. Individuals might file Phase 7 or Chapter 13 insolvency, depending upon the specifics of their scenario. Municipalitiescities, communities, towns, taxing districts, community energies, and institution areas may submit under Chapter 9 to rearrange.

If you are encountering economic obstacles in your individual life or in your company, possibilities are the principle of filing bankruptcy has crossed your mind. If it has, it additionally makes sense that you have a great deal of insolvency concerns that require solutions. Many individuals actually can not address the concern "what is bankruptcy" in anything except general terms.

If you are encountering economic obstacles in your individual life or in your company, possibilities are the principle of filing bankruptcy has crossed your mind. If it has, it additionally makes sense that you have a great deal of insolvency concerns that require solutions. Many individuals actually can not address the concern "what is bankruptcy" in anything except general terms.Lots of individuals do not recognize that there are numerous kinds of insolvency, such as Chapter 7, Phase 11 and Phase 13. Each has its benefits and obstacles, so understanding which is the most effective alternative for your present scenario as well as your future recovery can make all the difference in your life.

Top-rated Bankruptcy Attorney Tulsa Ok - An Overview

Chapter 7 is termed the liquidation personal bankruptcy phase. In a chapter 7 insolvency you can remove, wipe out or release most kinds of financial debt.

Lots of Phase 7 filers do not have a lot in the way of assets. Others have homes that do not have much equity or are in significant requirement of repair.

The amount paid and the duration of the plan relies on the borrower's residential property, mean revenue and costs. Creditors are not enabled to pursue or keep any type of collection tasks or claims throughout the situation. If successful, these lenders will be erased or discharged. A Phase 13 bankruptcy is very powerful because it supplies a device for borrowers to stop foreclosures and sheriff sales and stop repossessions and utility shutoffs while catching up on their protected financial obligation.

3 Simple Techniques For Chapter 7 Bankruptcy Attorney Tulsa

A Chapter 13 case might be useful because the debtor is permitted to get caught up on mortgages or vehicle loan without the hazard of foreclosure or repossession and is permitted to keep both exempt and nonexempt building. The borrower's plan is a paper describing to the insolvency court just how the borrower recommends to pay existing expenses while paying off all the old financial obligation equilibriums.

It gives the debtor the opportunity to either offer the home or come to be captured up on mortgage payments that have actually fallen back. A person submitting Discover More a Chapter 13 can propose a 60-month strategy to heal or become current on home mortgage repayments. If you fell behind on $60,000 well worth of home loan payments, you could recommend a plan of $1,000 a month for 60 months to bring those mortgage payments existing.

It gives the debtor the opportunity to either offer the home or come to be captured up on mortgage payments that have actually fallen back. A person submitting Discover More a Chapter 13 can propose a 60-month strategy to heal or become current on home mortgage repayments. If you fell behind on $60,000 well worth of home loan payments, you could recommend a plan of $1,000 a month for 60 months to bring those mortgage payments existing.The 2-Minute Rule for Bankruptcy Attorney Near Me Tulsa

Sometimes it is far better to stay clear of insolvency and clear up with creditors out of court. New Jersey likewise has an alternate to personal bankruptcy for businesses called an Assignment for the Benefit of Creditors and our legislation company will certainly look at this choice if it fits as a prospective strategy for your business.

We have actually developed a device that assists you pick what phase your documents is most likely to be filed under. Visit this site to utilize ScuraSmart and learn a possible solution for your financial obligation. Lots of people do not realize that there are numerous sorts of insolvency, such as Chapter 7, Chapter 11 and Chapter 13.

Below at Scura, Wigfield, Heyer, Stevens & Cammarota, LLP we deal with all kinds of personal bankruptcy cases, so we have the ability to address your bankruptcy concerns and assist you make the most effective choice for your case. Below is a brief check out the financial debt alleviation choices available:.

All about Bankruptcy Attorney Near Me Tulsa

You can only apply for bankruptcy Before declaring for Phase 7, at the very least among these need to hold true: You have a great deal of financial obligation income and/or assets a financial institution could take. You Learn More lost your vehicle driver permit after being in a crash while without insurance. You need your license back (bankruptcy attorney Tulsa). You have a whole lot of debt near the homestead exception amount of in your house.

The homestead exemption quantity is the higher of (a) $125,000; or (b) the region median sale price of a single-family home in the preceding calendar year. is the quantity of cash you would maintain after you sold your home and repaid the home loan and other liens. You can discover the.

Report this page